audit vs tax vs consulting

Audit Whats the Difference. Has a broader focus than tax.

Ey Thinks It Can Split And Cash In While Ringfencing Audit Liability

An example of scale.

. Audit is lowest paying but is a solidstable path to a good career. 02172010 I was wondering what you guys think is the better career path since it looks like Ill be stuck in accounting for a bit. RSM US Alliance provides our firm with access to.

Apr 9 2015 - 342pm. Moving from audit to TAS isnt easy but isnt like getting into either. The problem with consulting is the exit opportunities are more limited than auditing because most companies dont need an in-house person who does what a consultant does.

I would say if no boutique consulting. Not that unusual for an university graduate to receive an offer for big 4 audit and consulting job through on campus recruiting. A first-year auditor at Big 4 firms has an average salary of 58000year.

Consulting vs Auditing Salary. A Big 4 consultant may exit to MBB while a TAS may exit to BB IB. Compared to auditing a consulting career is more open to various backgrounds offers higher salaries and perks 80000year base for consulting vs 50000year for auditing along.

Compared to auditing a consulting career is more open to various backgrounds offers higher salaries and perks 80000year base for consulting vs 50000year for auditing along. Special consulting engagements e. Any suggestions are most.

Accountants perform services such as preparing tax returns auditing a companys financial records and designing strategies to reduce a companys tax obligations. Tax pays better but kind of pigeon. Audit vs Tax Tax vs Audit.

May 16 2005. The Big 4 firms pay their consultants over 30 more than auditors. While both are accounting professions the tax and audit paths can vary greatly.

Tax has a more specialized focus. Informal consulting engagements e. Below is a tabularized representation of the differences between choosing a career in tax vs audit.

Answer 1 of 7. Participation on a merger and acquisition team due. One caveat is that many firms will not hire undergrads directly into their TASFAS groups.

Having pursued my article ship for the past few months and just some knowledge of the subject I might throw into some light on this. The key difference between tax accountants and auditors is that tax accountants specialize in helping businesses and individuals plan for minimize and file taxes while auditors. Consulting is highest paying and probably most interesting depending on the specific type.

Participation on standing committees limited-life projects etc.

What Increases Your Chances For An Irs Audit Boudreau Consulting Llc

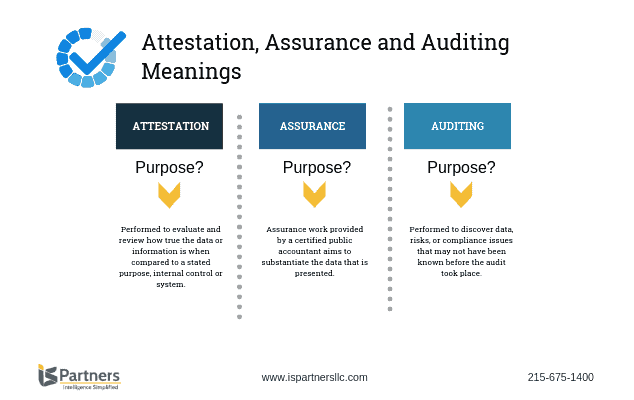

Defining Attestation Auditing Assurance I S Partners Llc

Ey Plans Global Audit Spin Off In Drastic Big Four Shake Up Financial Times

Pwc Reorganizes In U S To Split Tax Reporting And Audit From Consulting

Accounting And Consulting Services Audit Services Accounting Services Accounting

Accounting Firm For Tax Audit Advisory Services Windes

Audit Vs Review What You Need To Know Fml Cpas

Auditing Vs Consulting H H Accounting Services Phoenix Az

Audit Vs Tax The Accounting Major S Major Decision

Tax Or Audit That Is The Public Accounting Question

Why Ey S Split Of Audit And Consulting Arms Will Be Messy Financial News

How To Start An Accounting Audit Firm Or Tax Con By Anuu11 On Deviantart

![]()

Learning Career Path Soft Skills Development Delaware Cpa

Tax And Audit Consulting Services Landscape Banner

California Cpa Corner Tax Audit Advisory Irvine Orange County Los Angeles

Big 4 Accounting Firms Ranking Revenue And Salary Igotanoffer

Nfp Systems Consulting Accounting Services Audit Tax And Consulting Aronson Llc